⏱ 7-minute read

Most brands obsess over acquisition. New customers. Top-of-funnel. CAC optimization.

But the real inflection point? It comes after someone buys.

The gap between purchase one and purchase two is where customers either become valuable or churn. It's where unit economics flip from marginal to profitable. It's where a buyer becomes a customer.

Here's what the data shows:

A customer who buys twice is 3-5x more likely to make a third purchase. Repeat customers spend up to 67% more than first-timers. And most first purchases don't even cover CAC—the majority of profit materializes after the second order.

Yet this is the moment when brands rely least on data and most on generic one-size-fits-all marketing.

The implicit strategy is simple: hope they buy again.

The better question is: what are you intentionally putting in front of them next?

The Second Purchase Is Everything

This isn't just another transaction. It's the foundation of retention.

Second purchase probability tells the story. Getting someone from zero repeat purchases to one typically converts at 15-30%. But once they've bought twice? The odds of a third purchase jump to 40-60%. Customer retention curves bend upward. Churn risk drops significantly.

If the second purchase matters this much, the next-best-offer better be grounded in reality—not guesswork, and not, believe it or not, whatever has the highest margin this month.

So Ask yourself:

What products do our repeat customers buy together—and in what sequence?

Are there natural category progressions we're missing? (Think high rise denim with cropped tees, or makeup Primer to foundation to setting spray)

What's the typical time between first and second purchase for each product or cohort?

Are we recommending based on what converts, or just what we want to move?

Do our flows adapt to actual customer behavior, or are they static and one-size-fits-all?

The second purchase isn't about moving inventory. It's about establishing a relationship with your product line, but most brands are guessing at what to recommend next.

Get The Next Offer Right

In low-growth environments, the brands that survive don’t launch more campaigns. They act like marketers and portfolio managers.

Every SKU has a job.

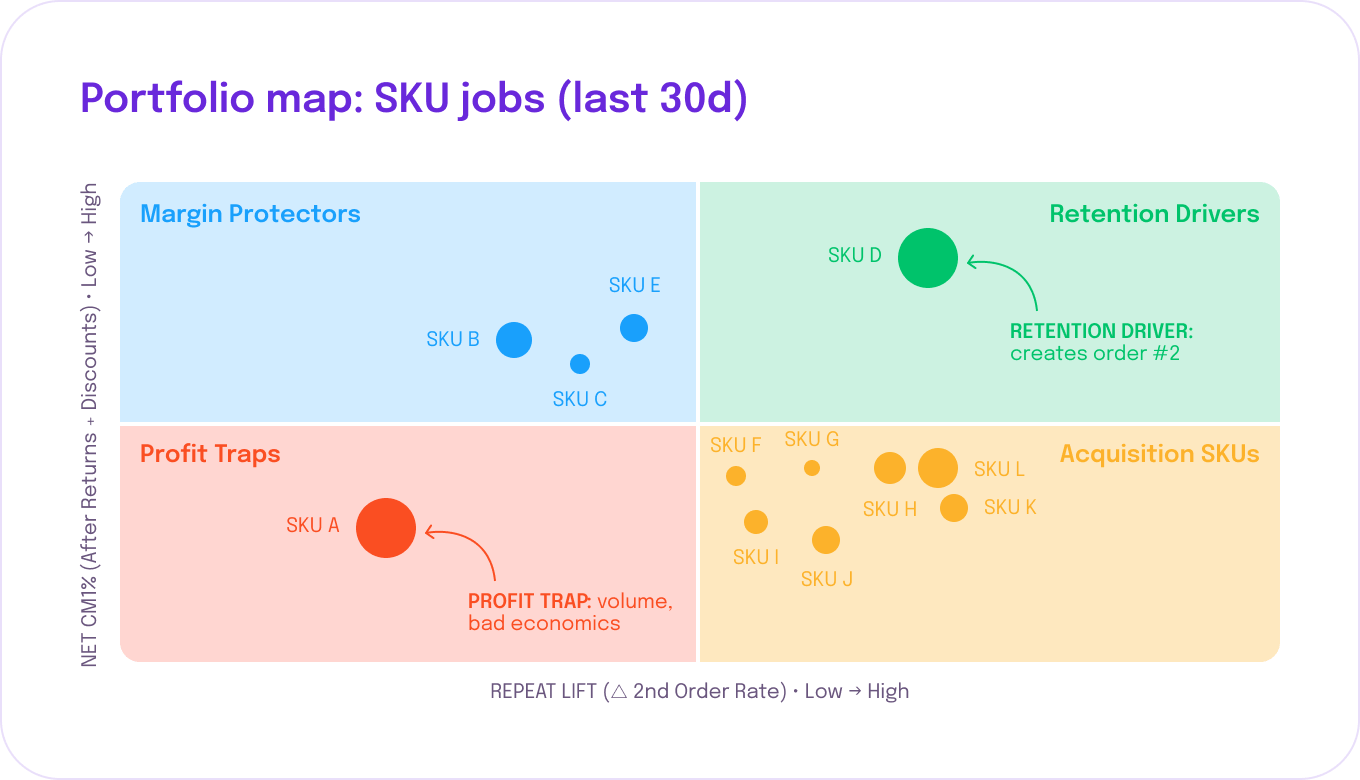

At a portfolio level, most products fall into one of four roles:

Acquisition SKUs

These bring customers in. They may not have perfect economics, but they create the conditions for a second order.

Retention Drivers

These are order #2. They naturally follow the acquisition SKU and unlock repeat behavior.

Margin Protectors

High CM1, lower velocity products. Perfect for upsells to established customers—not for first or second offers.

Profit Traps

High volume, bad economics. They look good in revenue reports and quietly destroy LTV.

Most brands run one marketing machine that treats all four the same.

When an acquisition SKU naturally leads into a retention driver, you’ve unlocked a compounding loop.

When you push margin protectors or profit traps as the second offer, you either leave money on the table or train the wrong behavior.

Make It Automatic

Operationalizing this isn’t complicated. It’s just disciplined.

Step 1: Map your portfolio

Explicitly classify SKUs into acquisition, retention driver, margin protector, or profit trap.

Step 2: Analyze behavioral pathways

Look at real sequences. What do customers who bought your acquisition SKUs actually buy next when they stick?

Step 3: Build dynamic second-purchase logic

Acquisition SKU → retention driver → timing based on behavior, not an arbitrary “7 days later.”

This is where RetentionX's Next-Best Offer Automation becomes critical: it analyzes actual purchase patterns, then triggers flows based on predicted next order dates, served up with the products your customers will actually convert on. No generic timers.

Step 4: Adapt by performance

If a SKU doesn’t drive repeat lift, it doesn’t belong in your second-purchase engine.

Step 5: Scale across channels

Email, SMS, on-site, paid retargeting—every touchpoint should understand the SKU’s job.

When portfolio strategy and behavioral automation align, the effects compound quickly.

Repeat rates climb.

Discount reliance drops.

CAC pressure eases because older cohorts start funding newer ones.

You stop training customers to wait.

You start building customers who come back—at full price.

The Bottom Line

Your customers are already showing you what works.

Your product portfolio is already telling you what each SKU’s job is.

Most brands ignore both.

The second purchase isn’t a follow-up tactic.

It’s the inflection point where growth becomes a system instead of a grind.

Stop guessing what to offer next. Start operationalizing it. The best operators we work with aren't manually updating email content every week, they're using behavioral prediction via RetentionX to automate the entire second-purchase engine, from SKU selection to send timing.

If you want a sanity check on which products are actually driving second purchases—and how I’d restructure your next-offer logic—reply “SECOND” and I’ll tell you where I’d start in your data.