⏱ 15-minute read

Here's a strange dynamic playing out at most mid-market DTC brands right now, and you've probably seen it up close.

Performance drops seemingly out of nowhere. Teams scramble for answers. Slack fills with theories about delivery issues, bugs, algorithm changes, or search for some setting that might have changed.

All the while, finance has been asking hard questions about marketing spend because cash is tight, contribution margins are under pressure, and the gap between what your marketing dashboards say and what the P&L shows just keeps growing.

The interesting part is that few brands stop and take a hard look at the foundation—the data and attribution layer—to answer the questions. So here's the obvious question: Why the disconnect?

The less obvious answer is that most brands are navigating performance marketing with a compass that broke somewhere around 2019. And nobody stopped to fix it because things were moving fast and the dashboards still showed numbers on the screen when you logged in.

The result is a kind of surreal reality: you can hit "record ROAS" while customer quality quietly deteriorates. You can hit your "CAC targets" without realizing your real CAC is twice as high after accounting for over-reporting and refunds. You can scale a channel's revenue while actually just cannibalizing another.

So let’s do it. Today, we are going to look.

Marketing’s Broken Compass

Many marketing teams are still stuck in the old ways and asking questions that made complete sense back in 2015:

"What's our blended CAC?"

"What's our ROAS this week?"

"Can we scale budget on this channel?"

These are channel questions, not business questions. And yes, the distinction matters more than it sounds.

The questions that determine whether you'll break through the next growth ceiling whether that's $30M, $50M, or $100M are substantially different questions than the ones that got you to where you are because growing and scaling are in fact, different things.

"What is the true LTV and payback of customers we acquire on each channel?"

"Are newer cohorts better or worse than last year's?"

"Which products and offers create loyal customers versus one-time shoppers?"

"What is real CAC after we reconcile platform data against financial ledger reality?"

Without answers to those questions, you can probably grow top-line revenue for years all while your customer file deteriorates from within and the platforms tell you everything is working. Your dashboards will still show green.

Until the sudden drops in performance that nobody can explain.

Part 1: The Three Structural Problems

Let me break down why companies face these issues and why some don’t. There are three illusions built into how many brands measure “performance”, and each one compounds the others.

The “Average Customer” Illusion

The problem with averages is that they flatten reality in ways that make bad decisions look reasonable. If you're steering your strategy based on "average customer value," you're almost certainly over-investing in channels that bring in low-value, one-time buyers.

That is because the acquired customers look fine when blended with the small group of high-value customers who drive most of your profit.

In reality, a small group, maybe 10-15% of customers often account for 40-60% of profit, while a long tail contributes almost nothing. So if your analytics collapses everyone into a single average, you can't see that. You're optimizing spend based on a number that hides the only dimension that matters: customer quality.

The “Platform Truth” Illusion

Every platform sees only a slice of reality and claims credit for anything it can plausibly touch.

If you add up what Meta, Google, TikTok, and email each report as "attributed revenue," you'll often get 150-200% of actual revenue. Which means your CAC calculations are fiction, and every budget decision is built on over-reported conversions.

The platforms aren't lying, exactly. They're just reporting from their own perspective. The problem is that most brands take those numbers at face value and make capital allocation decisions as if they represent reality. But, They don't.

The "Smart Algorithm" Illusion

Broad targeting and automated bidding optimize for cheap conversion events, not your unit economics.

If you don't explicitly teach platforms what "success" looks like by feeding them signals based on margin, LTV, and customer quality—they'll happily fill your customer file with whoever is easiest to convert today. Low CAC, terrible customers and continue to train their muscles on finding more of them.

The algorithms are smart. They're just not smart about your business. They're smart about finding conversions efficiently within the constraints you give them. So if you constraints are “hit this ROAS target” or “maximize conversions” without any additional context. The algorithm will do exactly what you asked and deliver exactly the wrong result.

How This Plays Out In Practice

Let me make this concrete with a real example.

We worked with a fashion brand, let’s call them “Company X” doing about $40M in annual revenue. On paper, their marketing was performing well. Meta and Google both showed healthy ROAS, and weekly reports didn't raise red flags.

But something felt off.

Some weeks, performance would inexplicably fall. Every dip triggered a new theory: creative fatigue, wrong placements, maybe shift to TikTok. Finance, meanwhile, was skeptical (as they are paid to be) as marketing said things were working, but cash flow and margins didn't match.

Here's what was actually happening (this took months to surface).

First, new customer cohorts were getting worse over time. Customers acquired two years ago had meaningfully higher LTV and repeat rates than those acquired recently. The top-line kept growing, but the real quality of the customer file had been gradually deteriorating.

Second, the channel numbers didn't reconcile. If you added up what Meta, Google, and email each claimed credit for, you'd get about 180% of actual revenue. CAC calculations were fiction.

Third, spend had drifted toward campaigns that generated cheap conversions—not profitable ones. Low-margin products, high-return customers. The algorithms were doing exactly what they were told. The problem was the instructions.

None of this was visible in any dashboard. Everything looked fine—until you stepped back and looked at the actual customer file.

Did we fix it? Yes. We rebuilt the marketing intelligence layer underneath it all.

We started by creating a tracking layer that treated the store (or ERP) as the source of truth, not the pixel. We also used RetentionX’s identity layer that linked devices and channels into real customer journeys. Finally, we started a reconciliation system that made platform claims agree with actual orders.

Once we started making budget decisions based on that unified view. Within a year, the same media budget was producing 32% more net new LTV. Not more orders—more valuable customers. CAC stayed flat, but payback time shrank by 40% because budget had strategically moved away from the and channels campaigns that generated cheap, low-quality conversions.

This is the difference between "performance marketing" and Marketing Intelligence. One reacts to yesterday's dashboard. The other runs the entire system on clean, unified data.

Marketing Intelligence: The Recipe For Change

Marketing Intelligence isn't a dashboard. It's a system. And every system that works has four layers that have to function together, which is exactly what we built inside of RetentionX.

Layer 1: Truth (Tracking + Identity)

Before anything else matters, you need to solve a foundational problem called Tracking. If your tracking is broken, every decision downstream is broken too.

Most brands don't realize how broken their tracking actually is because platforms have gotten good at making broken things look very functional.

Here is the standard pitch: "We do server-side tracking, we use first-party data." But if you pop open your browser's developer tools, you'll often see a maze of third-party scripts, pixels blocked by Safari, and cookies that expire in seven days.

Meanwhile, tracking completeness has fallen from around 85% to 60% or lower for most brands. Your dashboards still populate. Numbers still appear. The system doesn't throw an error—it just quietly undercounts.

This is a fact: Real server-side tracking requires three things: data collection on your own domain, processing on your own server (where ad blockers can't touch it), and your store / ERP as the source of truth for orders, refunds, and subscriptions.

RetentionX treats your store as the ledger. Critical events are captured as first-party events, streamed server-side, enriched with customer and margin data, then forwarded to platforms.

The browser? well it becomes a thin delivery layer. Never should it be where "truth" is derived.

Unlock: You Start Connecting The Dots

Tracking tells you what happened. Identity resolution tells you who did it—and that distinction turns out to matter more than most people realize.

For most products, the buying journey spans multiple sessions: someone sees an ad on Instagram, browses on their phone, researches on desktop, and converts on their laptop days later. If your system treats each touchpoint as a separate person, your understanding of customer behavior (and attribution) is wrong.

RetentionX Identity stitches together anonymous sessions, email addresses, device IDs, and purchase records into a single view per customer. That "anonymous" cart from last week gets linked once they purchase. Long cross-device journeys get reconstructed. Segmentation reflects actual customer behavior, not arbitrary session data.

The very important part: RX Identity enriches your existing tools. Better audiences for Meta and Google, deeper profiles in Klaviyo, cleaner metrics everywhere. Instead of letting each platform build its own partial identity graph, RX Identity becomes the master graph everything else plugs into.

Layer 2: Signal Optimization (Teaching Platforms What Matters)

Once you have clean tracking and unified identity, the next layer is teaching platforms what "success" actually means.

Most teams treat Conversion APIs as a checkbox. But if the underlying data is wrong, you've just moved bad data from browser to server. A robust setup starts from the store, enriches events with identity and margin data, and sends clean, de-duplicated events server-to-server.

Here's where it gets interesting: once conversions live in RX, you can define what "success" means per campaign. Use gross margin instead of revenue to find full-price buyers, not coupon hunters. Distinguish new versus repeat customers, so acquisition campaigns don't optimize for cheap repeat orders. Attach segments like "high LTV" or "high return risk."

This is the difference between feeding platforms random conversions and feeding them business outcomes.

Layer 3: Clarity (Reconciliation + Attribution)

Most brands live with three incompatible views: ad platforms claim credit aggressively, web analytics under-tracks, and backend systems know what cleared but have no context. You see the problem.

A good reporting system reconciles all three and answers: "Is our customer file getting stronger?" "Which channels drive incremental LTV?" "Where do platform claims diverge from reality?"

RetentionX reconciles ledger truth (orders, margin), channel truth (spend, platform conversions), and journey truth (attributed paths mapped to real customers). You see true CAC and payback per channel, identify over-reporting, and understand how spend changes affect LTV and retention. Not just short-term revenue.

Unlock: Allocating Capital vs Spending Budget

Attribution shouldn't be about philosophical debates like first-click versus last-click. It should answer: "If I move $100K from Channel A to Channel B, what happens?"

Good attribution tells you which channels bring high-LTV customers, which cannibalize existing demand, and how much “assist” value each provides.

RX attribution works because it has the full stack: clean events, unified identity, real order data. It operates on full customer journeys, not isolated sessions.

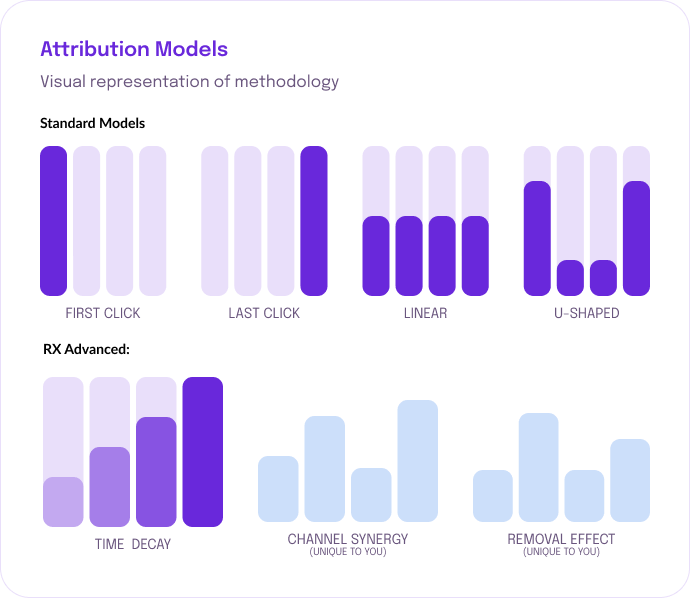

RetentionX doesn't declare a winner for you. Instead, we show the full picture: last click, first click, linear, and U-shape. Plus, we are introducing more advanced models like time decay channel synergy, and removal effects—all side-by-side.

See how performance shifts under each lens. The goal is clarity on where to spend your next $100K.

Layer 4: Action (Budget Optimization)

Once everything else is in place, you can ask: "What budget and mix do we actually need?"

Most budget decisions in the companies stuck in 2015 sound like:

"Meta feels hot, add 20%." "Google's expensive, let's trim." "Let's test $50K on a new channel."

Those aren't statements of optimization. That's called exploring the wilderness without a map.

A real budget engine tells you where the next dollar does the most good, what happens if you shift spend, and what mix you need to hit specific goals. RetentionX Budget Optimization (In Beta) uses attribution data and response curves to model diminishing returns, respect channel roles, and optimize for profit and LTV—not just short-term revenue.

The goal is to get to a point where you can say with confidence: "At this point in the quarter, to hit our profit and LTV targets, here's the recommended allocation across Meta, Google, email, and retention campaigns."

That's Marketing Intelligence doing what it's supposed to do: turning customer journeys and conversion events into budget decisions and trade-offs.

Final Thought: This Can't Be Duct-Taped Together

I personally know brands using five separate tools for tracking, identity, attribution, reporting, and budget optimization. I guess, It's better than nothing.

But it certainly defeats the purpose of creating a source of truth.

When your marketing and analytics stack is duct-taped together, your tracking tool doesn't speak fluently to your attribution tool. Your identity graph lives in one system, conversion data in another.

Btw - Every change you make to your system requires multiple vendors to adapt to it. You're constantly reconciling conflicting numbers. Nothing compounds.

RetentionX was built as an integrated system. One reliable spine for customer data. Analytics, activation, and automation talking to each other. Fewer tools, less overhead, more outcome per dollar. Every campaign, test, and cohort makes the whole system smarter over time.

If your dashboards scream "winning" one week and "disaster" the next and neither shows up in your P&L—you don't need another ad account setting.

You need Marketing Intelligence. A single operating system that connects who you acquire, how they behave, what they're worth, and where your next dollar should go.

What Changes with Marketing Intelligence (Tactically)

When you shift from platform dashboards to Marketing Intelligence, here's what happens:

In the first few weeks, your numbers start making sense. Platform claims reconcile with store reality. Data discussions about whose data is "right" start to disappear.

In the first month, your attribution shifts. You see which channels actually drive new customers versus cannibalizing demand. Budget decisions will start to get clearer and easier.

In the first quarter, your customer file improves. You're acquiring fewer one-time shoppers, more repeat buyers. CAC should stay close to flat, but LTV climbs because you're optimizing for customer quality.

By the end of the first year, you're running a different business. Marketing isn't a black box. It's a system you control, optimize, and scale with confidence.

Want to see what this looks like for your brand?

We're offering special access to brands that want to see how Marketing Intelligence changes their view of acquisition, retention, and profitability.

Book a Demo to get started.

-Alex

The Marketing Intelligence Health Check

If you've read this far and you're wondering where to start, I am going to leave you with simple diagnostic framework you can run with your team. Go through these questions honestly.

Truth Layer: Foundation Assessment

Can you reconcile Shopify revenue with Platform Revenue (within 10%?)

Do you know what % of conversions are captured today?

Can you connect anonymous browsing to known customers after they purchase?

Signal Layer: Data Quality Assessment

Can you reconcile Shopify revenue with Platform Revenue (within 10%?)

Do you know what % of conversions are captured today?

Can you connect anonymous browsing to known customers after they purchase?

Clarity Layer: Checking Numbers

Can you reconcile Shopify revenue with Platform Revenue (within 10%?)

Do you know what % of conversions are captured today?

Can you connect anonymous browsing to known customers after they purchase?

Action Layer: Allocating vs Spending Budget

Can you reconcile Shopify revenue with Platform Revenue (within 10%?)

Do you know what % of conversions are captured today?

Can you connect anonymous browsing to known customers after they purchase?