The biggest retail moment of the year is officially behind us and now that everyone has some time to breath, let’s dive right in.

First, a warning sign. If you can’t say which products your new BFCM customers bought, channels they came from, their profitability, or how likely they are to return, there is a chance you are celebrating volume without understanding quality.

Record-breaking weekends have the potential to be so much more, but in many cases they come with weaker contribution margin, and a retention team rehabbing one-time customers throughout the following year.

I say this all the time, but Black Friday shouldn’t be a the finish line for 2025 – it’s the starting line for next years growth. Every customer you acquire in that weekend is a cohort you’ll live with all of next year.

So, the question isn’t “how big was the spike?” but “what kind of customers did we just add to our file, and what trajectory are we going to put them on?”

Let’s explore.

Picture two brands doing roughly $40M/year, both making a serious push for maximum revenue during BFCM:

Brand A: Leans into deep discounts and very broad targeting. They reach revenue records, run out of warehouse capacity, and everyone high-fives.

Brand B: Runs meaningful but controlled offers, focused on high-LTV products and geographies that over-index on margin and repeat customer creation. Their weekend was “good but not crazy top line numbers” in Shopify.

Twelve months later. Let’s examine a very likely scenario:

Brand A: Their BFCM cohort has had very low repeat purchase rates, ugly return behavior, and only reliably wakes up for the next promo.

Brand B’s cohort is smaller, but is now driving strong repeat revenue, healthy cross-selling, and a meaningful chunk of the year’s profit.

Same holiday, same calendar, very different futures in the following year. Not because one “won” BFCM, but because one strategized the moment around around quality customers from the beginning.

Said differently. During BFCM, you didn’t buy revenue. You bought a cohort.

Thinking that way, If you want BFCM to fund your next year instead of dragging it down, let’s start think about that cohort differently now.

How you should think about BFCM cohorts

For starters, I want to share something that I say to all of the brands that I work with. Which is that their CEO and CMO should be completely aligned on these principles:

Principal 1: BFCM is not a campaign, it’s a timestamp on a cohort.

Those customers will behave differently from your BAU cohorts, and you should expect that and design for it.

Principal 2: Discount depth teaches behavior.

The more aggressively you train people to buy only at -30% or -40%, the harder it is to move them back to full price or light promos later.

Principal 3: Product mix sets the LTV trajectory.

Entry through low-margin, high-return, “gimmick” SKUs creates a fundamentally different customer base than entry through sticky, replenish-able, loyalty-driving products.

Principal 4: Channel and audience mix define quality.

Affiliates, coupon sites, broad social and brand search all bring in very different types of buyers; BFCM amplifies those differences.

Principal 5: Be able to describe the BFCM cohort in one paragraph

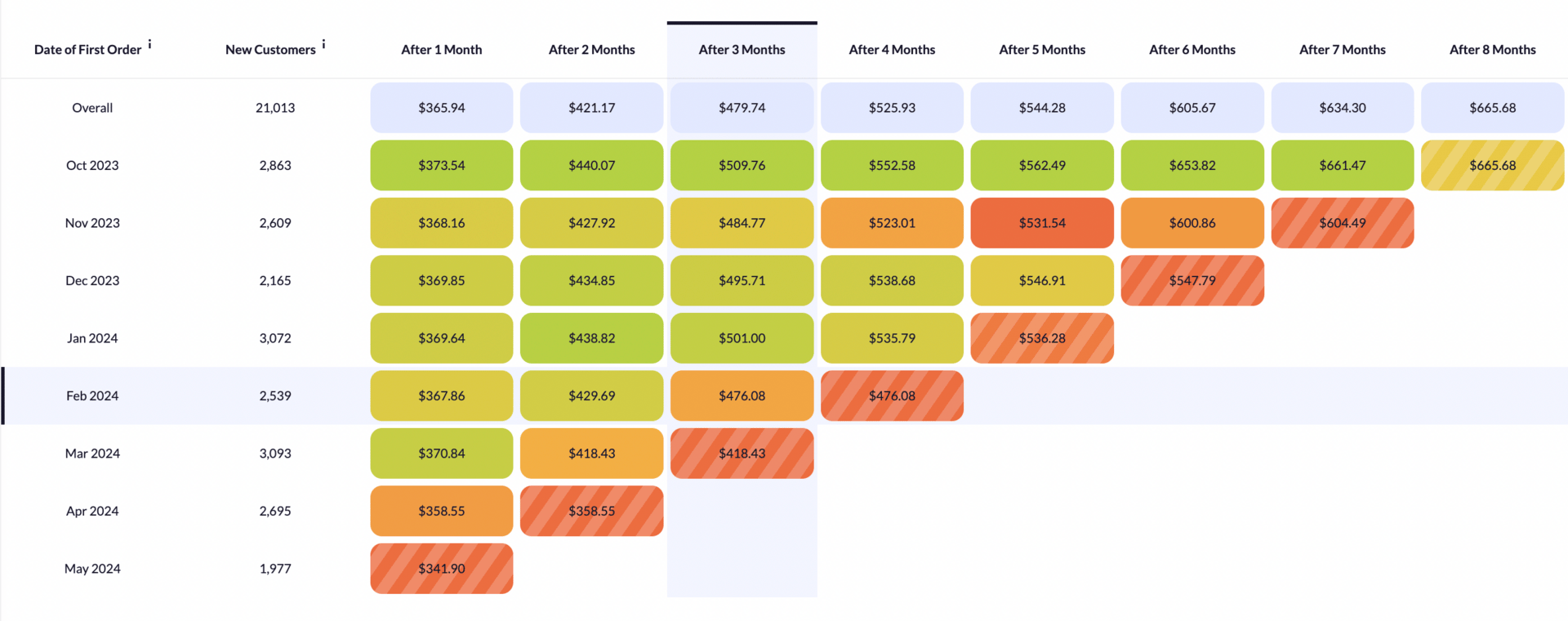

You should be able to say: “These are the products, discounts, channels and behaviors we acquired and this is how we expect them to perform over 3, 6, 12 months.”

It’s simple but very meaningful. Once that mindset clicks, the next step is turning it into operational reality and not a “how do we” discussion.

What to actually change on Monday

I like to get tactical. So here’s is a very simple and concrete way to start your team executing on this shift if they are not already (quickly):

Step 1: Tag BFCM as its own cohort in reporting

Create a “BFCM 2025” customer tag and look at that cohort’s repeat purchase rate, AOV, return rate, and contribution margin separately from the rest of your file. Don’t let it disappear into blended numbers because you should be tracking this YOY.

Step 2: Build a BFCM product recap view

For customers whose first order with your brand happened during what you consider to be the BFCM time period, rank the SKUs purchases from that segment by:

Number of new customers acquired

6–12 month LTV

Customer return rate

Also, mark which SKUs are end up as true heroes (high LTV, low returns) and which are fake heroes (great first-day sales, terrible long-term economics).

Step 3: Build a BFCM channel view.

For that same cohort, break out acquisition channel and key audiences (Meta prospecting vs retargeting, Google brand vs non-brand, affiliates, influencers, etc.) and compare their LTV, payback and refund behavior. You will almost always see channels that look great on CAC but terrible on real LTV.

Step 4: Map behavior by discount band.

using the same cohort, segment them by discount level (e.g. 0–10%, 11–25%, 26–40%, >40%) and then track compare their long-term performances. This is often where you realize that the last few percentage points of discount are buying you people who never become profitable.

Step 5: Design a dedicated post-BFCM journey.

Don’t drop these buyers into your generic welcome and BAU flows. Build at least one dedicated path designed to:

Introduce full-price or light-discount behaviors

Cross-sell into your most loyal, high-margin products

The goal is to move the BFCM cohort into your best segments as quickly as possible and treat them as a distinct asset you need to shape, not just “more names on the list.”

Once you start to look at BFCM through this lens, the “big win” is not a screenshot of your best hour in Shopify. It’s the shape of the cohort you wake up with on Monday.

Which products they anchored on, how deep they discounted, which channels they came from, and how that will show up in your LTV and contribution margin curves next year. It’s about kicking off the shape of the next 12 months of your customer file.

Get this right, and Black Friday stops being a yearly adrenaline rush followed by a hangover. It becomes a deliberate way to preload your brand with the kind of customers you actually want to grow with.

The screenshots from the weekend will look fine either way. The difference shows up in your LTV, your retention, and your bank account.

Want more information? Read the full playbook

If you want a sanity check on your own BFCM cohort quality and how to turn this year’s buyers into next year’s profit, reply “BFCM” and I’ll tell you what I’d look at in your data first.