⏱ 5-minute read

For the last decade or so, eCommerce brands and founders were desperate to break free from Amazon.

Why? Their goal was to own the customer. Be independent. Build something real. Without being reliant on Amazon. Who would happily point your customer into the hands of the closest competitor.

A decade later, most of them subsequently built the exact same trap on Meta.

The Uncomfortable Truth

Most DTC revenue is third-party revenue. It exists only as long as a platform decides you're allowed to access buyers at a tolerable price.

In practice, that means: if Meta sneezes, your business gets pneumonia. If you hear "we can't grow this month because Meta is weird," what you're really hearing is: “we don't own demand, identity, or repeat purchases.”

Many brands spend 30-50% of revenue to acquire customers. Survival depends far too much on a single auction staying stable. One tracking change, one algorithm shift, one CPM spike and a "growth strategy" turns into cashflow panic.

The truth is that many of us shifted from working for Amazon to working for Meta. And now we wonder why growth feels so heavy. On Meta, we exchange cash for attention and then hope the platform lets us do it again tomorrow.

This is not a business model. It’s a subscription to uncertainty.

Math That’s Hard To Hear

A typical eCommerce brand today faces common conditions: Good volume, challenged margin, high acquisition cost, low repeat rates, and inconsistent growth.

So, the question of “what happens if we stop spending today” is crazy and result leads to serious impacts. So, In case you don’t already look at your business this way, use this as a roadmap to understanding this equation for you.

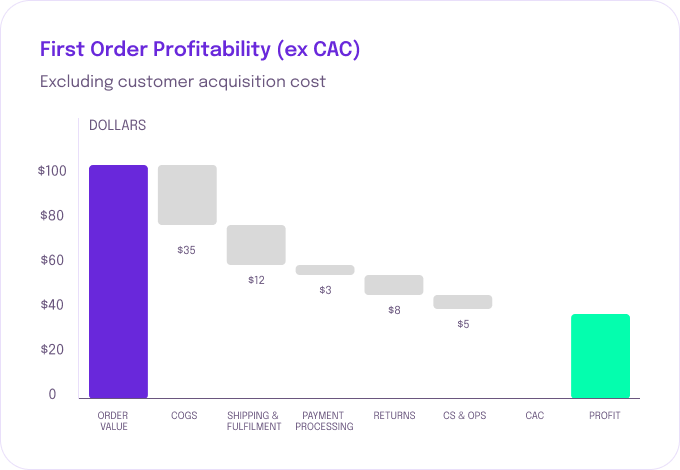

Assume the following costs on a $100 order.

AOV: $100

COGS: $35

Shipping + fulfillment: $12

Payment processing: $3

Returns allowance (15%): $8

Customer service + ops: $5

Whats left?

CM (Contribution before acquisition): $37

$100 - (35 + 12 + 3 + 8 + 5) = $37

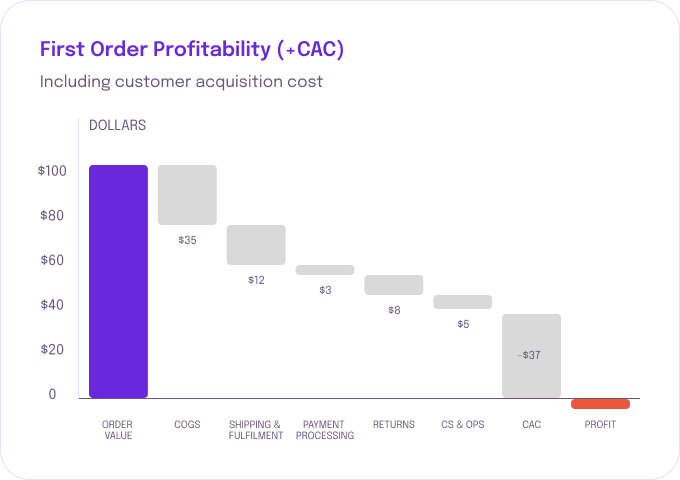

Now add CAC to the equation: $40

$100 - (35 + 12 + 3 + 8 + 5+ 40) = -$3

You "grew revenue" and lost money while Meta collected $40 immediately with near-zero marginal cost. You take the inventory risk, fulfillment complexity, returns, and cashflow timing. Meta takes instant cash at high margin.

At the end of the day, you're compounding their business—not yours.

A Casino Problem: The Ecosystem Around Meta

It's not just Meta that are benefiting, many agencies (with exception) operate like gamblers with someone else's credit line.

They spend as a proxy for "work completed"—not profit, not payback, just activity. They celebrate when they win, and stay quiet when they lose. It pays to keep you on the hook: "One more creative. One more test. One more structure”. They can even blame the house for losses ("Meta bug," "tracking broke," "algo shift").

In the end, when they win, it's skill. When they lose, it's the house. To be blunt, this is the same logic addicts use: chase losses, rationalize failures, magnify wins, pull the lever again.

Your P&L eats the consequences.

The Antidote: Proprietary Revenue

Proprietary revenue is what you can generate without external permission:

Email/SMS-driven repeats

Direct + branded organic

Lifecycle offers based on real behavior

Product mix that improves margin + repeat probability

Proprietary doesn't mean "no paid ads." It means paid becomes an input—not the engine. Paid is how you acquire attention.

Proprietary is about how you monetize attention repeatedly. To build proprietary revenue, you need one closed loop:

Identity: Who exactly is this customer across channels and sessions?

Truthful tracking: What did they actually do—without attribution noise?

Cohort economics: What's their 60/90/180-day LTV, repeat rate, and margin by acquisition source

Activation: What triggers the second purchase and builds owned revenue?

Most brands can't run this loop because their tools are isolated. Shopify sees orders, Klaviyo sees emails, Meta sees clicks, GA4 sees sessions—and none of them agree on who the customer is.

So you can't answer the only question that matters: Did this paid cohort convert into proprietary revenue—or did we just fund Meta again?

The test is simple.

Ask yourself: If Meta disappeared tomorrow, how many weeks would you last? If the answer is anything like “not many”. You don’t have a marketing problem, have an ownership problem.

Want to start building proprietary revenue? See how Marketing Intelligence closes the loop.