Some products look incredible on paper. Strong click-through. Healthy CAC. Great creative performance. But here's what the dashboard doesn't show: those same SKUs might be chipping away at your unit economics.

We see this constantly. A product wins attention—seasonal kit, limited drop, discount bundle—but the customers it brings in buy once and disappear.

Meanwhile, a “boring” serum or a basic cleanser sits lower in the media mix, even though buyers of that product come back every 6 weeks and layer in more SKUs over time.

One product looks like a hero. The other actually behaves like one.

The Distinction That Matters

Habit products are SKUs that end up in your customers' daily or weekly routine. They run out. They get replenished. They create a natural rhythm of repeat purchases and they pull other products along with them.

Fake heroes are SKUs that perform well in acquisition metrics but produce customers who don't return frequently (or ever). They're often gift-able items, seasonal, or novelty-driven. Fake heroes have a way of feeling like wins in the moment and start feeling like losses 12 months later.

This creates issues because most brands allocate media spend based on front-end performance—CTR, CAC, ROAS—without weighting for what happens after order one.

Habit-forming products get overlooked, and retention teams are left trying to engage customers who were never going to stick in the first place.

Breaking that cycle is how durable growth actually happens.

Three Shifts Worth Making

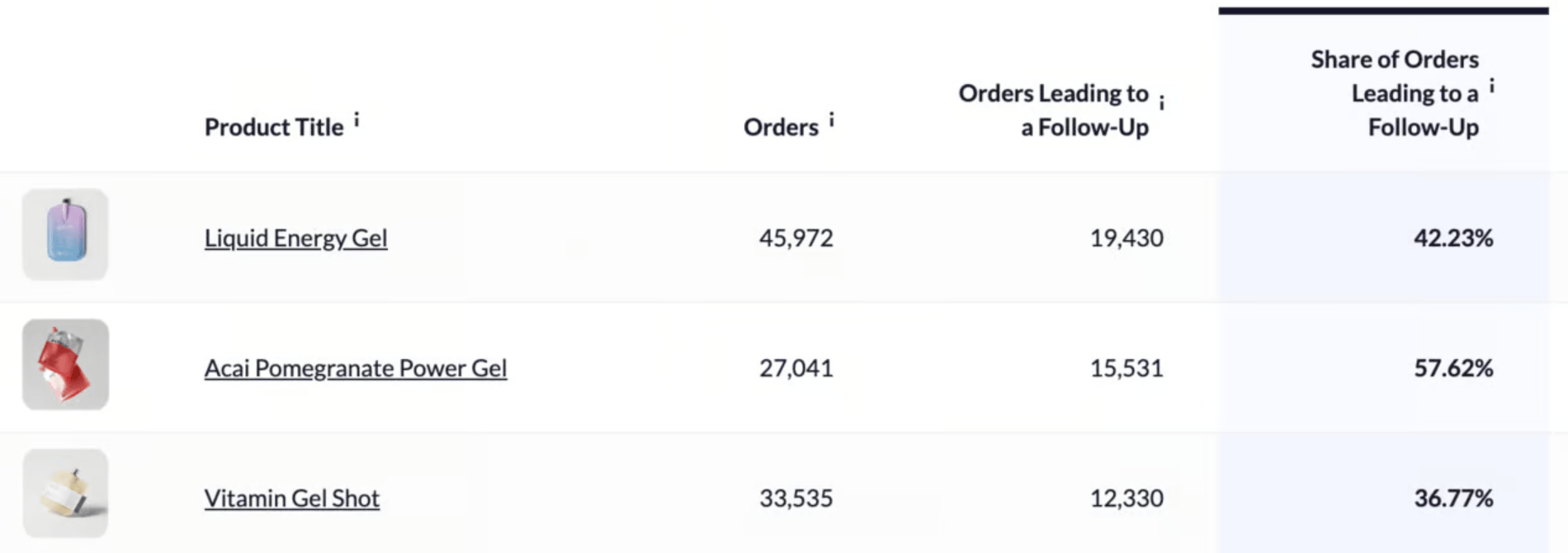

Not all revenue is equal; recurring units are worth more. A product that gets repurchased 5–10 times over 12–18 months is fundamentally different from a one-off im"Stickiness" is a metric, not a feeling. You can actually measure stickiness. Repeat purchase rate by first-product SKU, average units per customer over 12 months, time between repurchases. Look at these metrics across your SKUs and the data will show you which products actually behave like habits—and which ones just look good in ads.

Your CAC ceiling should be higher for sticky SKUs. You can rationally pay more to acquire a customer into a product that repeats frequently with healthy margins. When you lead with non-sticky SKUs, you're trapped in a tight CAC box with no future contribution margin to bail you out. By knowing the SKUs you can optimize acquisition and CAC.

Acquisition and retention aren't separate problems. If the marketing team is pushing customers into fake heroes, lifecycle teams are forced to do very hard work later. If acquisition leads with habit products, retention becomes guiding a journey the customer already wants to take.

Where I'd Start

Priority 1:

Identify your true habit products with data. Pull a 12-month view and calculate, for each product that frequently appears as a first purchase: repeat rate, average units per customer, contribution margin, return rate. Highlight the SKUs where customers come back again and again with strong margin.

Priority 2:

Shift spend toward habit builders. Rebalance creative, landing pages, and feed logic so your stickiest products lead. Fake heroes can still exist as upsells or seasonal plays—but they shouldn't be your front door.

Priority 3:

Update your reporting to include stickiness. Add one line to your monthly review: share of acquisition spend going to habit products vs. everything else. When leadership sees that number, the conversation changes.

If you do this well, your revenue stops being a series of spikes and starts to feel like layers: each cohort adds recurring, high-margin revenue on top of the last.

Acquisition isn't about fighting retention—it's about feeding it. In other words: your media plan should look like a map of your customers' routines, and less like a merch team's seasonal mood board.

Want to dive in further? Read my article on product stickiness

If you want a sanity check on which of your products are true habit builders—and how much of your spend is actually backing them—reply "STICKY" and I'll tell you what I'd look at in your data first.