One DTC brand doubled revenue in 12 months— …but nearly ran out of cash doing it.

Why? Because their CAC ballooned, their repurchase rate dropped, and no one was watching margin decay.

This article breaks down the most common (and expensive) scaling traps—and how to avoid them.

Crucial piece of advice for brands experiencing their first wave of growth

Imagine this...

Your brand is riding a wave of success.

Sales are booming, and your brand is gaining traction.

VCs offer you money to amplify that success by significantly increasing your advertising spend. The appeal is undeniable-you're on a high and you want to keep the momentum going. Plus, you'll have the money to invest.

So, why not go all in?

Here's what often unfolds over the next 6 months:

Initially, everything seems great. Your ads are performing well because your brand is trending, and customer acquisition costs (CAC) are low. However, this honeymoon phase doesn't last forever. Organic growth begins to wane, as it inevitably does in any growth cycle.

As a result, the once impressive performance of your ads starts to fade. The actual value these ads were adding becomes questionable, likely overstated by optimistic weekly reports.

Before long, your CAC increases dramatically. What once took a few months to see a return on investment now stretches to 12 months or more.

As a consequence, your cash reserves dwindle rapidly, putting your business in a precarious position.

I think a lot of brands can relate to that.

I have the following piece of advice for you:

Sustain Organic Growth

During the initial growth phase, focus on maintaining a healthy profit margin on the first order from new customers.

Continue to invest in organic growth strategies such as SEO, content marketing, and social media engagement. These methods build a sustainable foundation that doesn't rely solely on paid advertising.

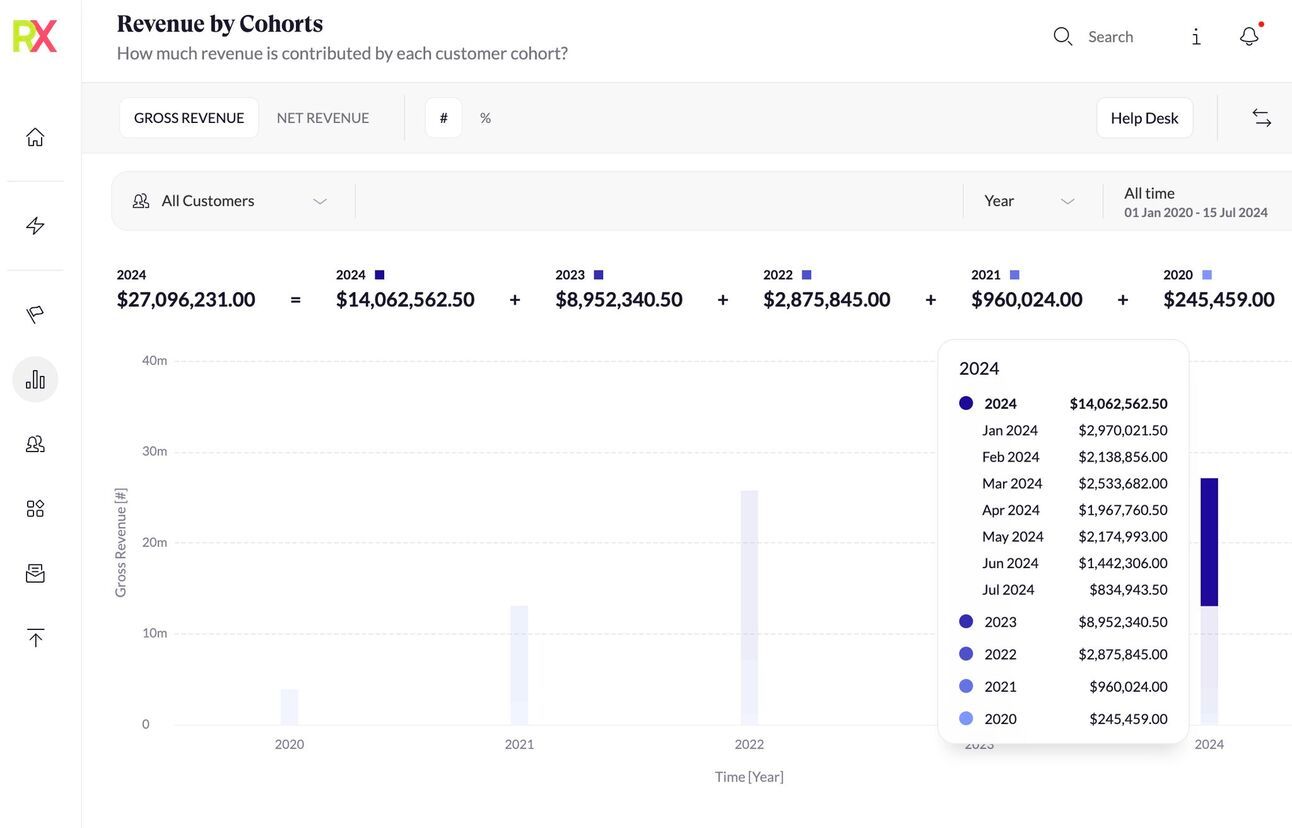

Monitor CAC & LTV Cohorts Closely

Keep a close watch on your customer acquisition costs and be wary of rapid increases.

Consider diversifying your marketing spend to include a mix of organic and paid.

Make sure your customer quality doesn't suffer as you scale. Cohort analysis is a must. Your initial LTV assumptions must be sustainable. They must hold as you scale.

Avoid Over-Scaling Too Quickly

Don't rush to scale your advertising spend without understanding its true impact on your business.

Increase your advertising budget gradually while closely monitoring the results. Avoid sudden, unsustainable spending spikes.

Protect First-Order Profitability

Ensure that your first-order profitability remains robust as you scale.

Optimize your product pricing and cost structures to maintain healthy first-order margins. This ensures that your business remains profitable even as you invest in growth.

Plan for Long-Term Sustainability

Focus on building a business model that balances short-term profitability with long-term growth.

Develop a strategic plan that includes multiple revenue streams and continuous improvement of your products and services. This will help create a resilient business that can withstand market fluctuations.

Add-on: You have to think of customer retention as compound interest

Consider the following example:

You earn $50,000 a year for your entire working life.

Your savings rate will also remain constant at 5%.

This equates to $208.33 in monthly investable savings.

You save for 45 years, a typical working career.

If you saved this money but never invested it, you'd end up with a total retirement fund of $112,500. Think of this as the classic customer acquisition only scenario with 0% customer retention. One-time customers only.

That's only $4,500 in annual retirement income, assuming a 4% withdrawal rate.

Not exactly living high on the hog.

Now the magic happens....

The only variable we're going to change for the first calculation is the rate of return on our savings.

Instead of zero percent appreciation, we're going to assume a 9.8% compounded rate of return (the average return of an index fund) on your money.

Believe it or not, this will take your savings from $112,500 to a staggering $2,035,947 over the same period of time.

This is the magic of compounding and the difference between companies with high customer retention rates and those without.

Top line and profit can easily be 20x higher.

And compounding, and therefore retention, is very sensitive to small changes. So any small improvement can have a huge impact on your medium to long-term performance.

Going from 9.8% interest to 12% (imagine this as your increase in repeat purchase rate) will more than double your savings in the same period: from $2,035,947 to $4,469,728.

At the same time, reducing your savings time (higher customer churn) from 45 years to 40 years will reduce your savings by 40%! ($1,239,909 instead of $2,035,947).

I can only encourage you: work on your customer retention. It pays off exponentially compared to any other metric.

TIP: I know that’s a lot to take in! I’ve been in the same position—feeling overwhelmed about where to find the data, how to get started, and how to embed an LTV-driven mindset into my teams. That’s why we built RetentionX. As a brand operator, it has been my #1 internal tool to turn things around before launching it as publicly available software.